Related Topics

Whither, Federal Reserve? (2)After Our Crash

Whither, Federal Reserve? (2)

How Should We Reform Real Estate Finance?(2)

|

| NATION-WIDE PRICE DECLINES |

NATION-WIDE PRICE DECLINES. One much-mocked slogan from the real estate boom days was: real estate prices never go down. More precise words which justify ever saying such a thing are: national home price averages have not declined significantly in 75 years when corrected for inflation. But regional prices bounce around plenty. Deception lies in hinting overstretched homebuyers can't lose their shirts, which they definitely can and definitely will. However, the underlying steadiness of real estate values resurfaces if bursts of irrational exuberance average against sudden bouts of panic. When reversion to the mean is recognized, it might be fairly cheap for the real estate market to re-insure itself, one region (or time period) balancing another. Distressed housing is generally found in regions of an industrial slump; such regions need stimulus. Inflated house prices are found in gold-rush regions; they need restraint. We have said in other places that a universal 20% down payment would be required to protect individual mortgages against the risk of a major national decline in house prices; in earlier epochs, such down payments were regularly demanded. However, if one region's downs balance against another region' sups, the remaining risk would be the simultaneous national decline, which must be rebalanced over longer time periods. By definition alone, that's less common, hence cheaper to insure against. It can still occur, but there would be more tranquil time to build up loss reserves. We might as well say right here that sad experience with political raids on entitlement "lock boxes" (like Social Security) emphasize the need to protect reserves from politics by sharing control with independent entities.

The suggestion made here is: to divert the capital gains tax liability of real estate sales away from the U.S. Treasury, toward a fund for purchasing bank equity in depressed regions. This is regionally counter-cyclic and can be made nationally counter-cyclic because although more equity expands the ability of banks to loan, investors suspect a bank is in trouble whenever it announces a public stock issue. (Of course, selling stock might also mean the bank has more business than it can handle). Sales of bank stock by the proposed fund, however, would always be regarded as a sign the bank really doesn't need assistance. Periodic rebalancing of the fund should amount to buying low in one region or time period and selling high in another, generating more long-term reserves for really severe national dips. The one voiced concern with this scheme is that the present $250,000 capital gains exemption on home sales might unduly starve the fund; one more example perhaps of political meddling stimulating unwise real estate ownership but nevertheless suggesting a possible adjustment lever for implementing the counter-cyclic intent of the scheme.

The point of using capital gains liability as a funding source is a general perception that the government isn't exactly entitled to tax capital gains created by inflation. Using a pro-cyclic revenue source for a counter-cyclic program should force the fund to respond to market forces for raising cash, propelling it toward hard-nosed investment choices when pressure builds to spend it for political purposes. But, if additional revenue exactions from homeowners ever prove to be needed, they should be voluntary, matched with participation rights. Involuntary taxation would be much resented; people threatened with a foreclosure cannot contribute, while anyone with 20% equity in his home is secure and does not need additional insurance. So, holding adequate equity in the house should excuse a homeowner from the reinsurance scheme, thus creating an inducement to save up to reach that threshold. It should be noted in passing that holding an 80% mortgage, whether by down payment or paying it off, considerably reduces client temptation to "give back the keys" when sales values decline below the size of a mortgage, because of it's less likely with a buffer zone. Surrendering the house has even acquired a wry description based on two keys in an envelope: "Jingle equity."

|

| MORAL HAZARD2 |

MORAL HAZARD. Much has been made of the risk that an originating bank will exercise less care about loans to risky clients when the plan is to sell the mortgage immediately to an aggregator. Some salesmen are "predatory", some clients are "dodgy". Loans which do not even require verification of the borrower's income or assets are "liars loans", ranked in the "mezzanine class of Alt-A" to obscure the real meaning. Almost immediately the cry has gone up to make the originating banks "have some skin in the game", which is to say they should retain a portion of each loan in their own portfolio. To do so would reduce the bank's working capital and hence its ability to loan so much, evidently a good thing at the moment. Just how much of each loan to require would have to vary with the economy, raising the question of who is to say.

Computers, which did so much to bedazzle these matters, ought to be able to clarify them as well. It seems possible that to label the tranches with their varying proportions of originator retention might be adequate because the market would penalize risky behavior at a higher cost. It might not be necessary to go even this far; maintaining a rating system for different originating banks, based on their default rate at two years, or delinquency rate at six months, might serve the purpose. Some sort of informal arrangement already seems to be operating among "vulture" investors. Mortgagees report that if they miss a mortgage payment, their credit card interest rates mysteriously go up within two weeks. With similar reporting system in place, it should not be difficult to evaluate the differences between banks which had originated mortgages, and in turn label for investors, the risk history of various tranches of various mortgage-backed securities. The great attractiveness of securitized loans is their efficiency and reduced cost. When hazardous behavior leads to higher costs for the perpetrator, the market will take care of the discipline. If clever computers make it harder for crooks to conceal responsibility, matters may quickly respond.

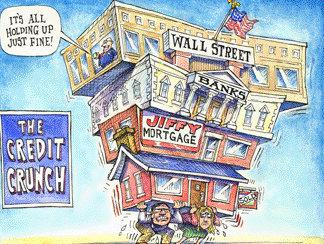

EXCESS LIQUIDITY. It's quite plausible to contend the housing crash had its origin elsewhere, in tidal waves of money from abroad. In that case, fortifying the mortgage market will only lead to bubbles somewhere else. Oil is a likely example, and commodities, in general, seem a likely place to look for the next bubble. After that, some other bubble. Eventually, "nominal" inflation will resemble a giant swiss cheese, with only wages standing as "core" inflation. Since cheap labor abroad started this whole spiral, eventually American labor will find its wage level effectively depressed to match the foreign one by the inflation of every other cost in the economy. Somewhere along the line, foreign labor will lose its price advantage, and foreign consumption will rise to equal our own. The attractiveness of immigrating to America will decline, as will the attractiveness of buying American stocks. Buying American goods will increase, however, and somewhere an equilibrium will be achieved. Only efficiency enhancement seems like a nearby frontier we can conquer, and the securitization of debt is one of the great efficiencies of the century. The most important thing we can do about the real estate credit crunch of 2007-2010 is to recognize that it grew out of comparatively minor fumbles with a magnificent idea. Let the financiers pick up the ball, and run with it.

Originally published: Monday, July 28, 2008; most-recently modified: Sunday, July 21, 2019