Related Topics

Banking Panic 2007-2009 (1)

Mankind hasn't learned how to control sudden wealth, whether in families, third-world countries, or the richest nation in history. The world banking crisis of 2007 is the biggest example yet.

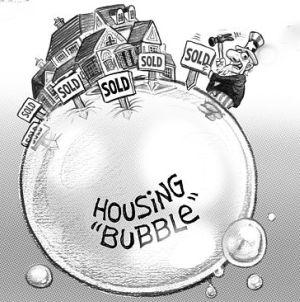

The Housing Bubble

|

| Alexander Hamilton |

Since ups and downs of the American economy have relentlessly followed each other since the time of Alexander Hamilton, it's unfair to blame the President who happened to be in office when each bump began; but we do it anyway. Two bubbles began during the presidency of George W. Bush, the dot-com surge then the collapse of 2001, and the housing bubble which rose from the ashes of that collapse, crashing in turn in the summer of 2007. Both episodes can be viewed as responses to the world money surplus which grew out of globalization, which itself can be viewed as growing out of the computer revolution which started around 1975. Maybe that's wrong, but it's common to believe it is right. The world economy is an over-inflated tire, so bubbles appeared at weak spots. When money fled the stock market of electronics stocks, it moved to American real estate, facing us with the choice of another bubble to follow this one unless the collapse of this bigger bubble deflates so badly we have to whimper through a depression for a couple of decades.

This grand preamble is intended to answer whether a housing surplus caused the bubble, or a money surplus did. Economists at the Federal Reserve, charged with examining such questions, are firm of the view that money surplus came first, causing too many houses to be built. The money surplus, in their view, grew out of the tendency of people (in this case, Chinese) to get prosperous before they learn how to spend their new wealth, so they save it. Without further debate, we will assume excessive savings in developing countries tended to swamp the world financial markets, and if it hadn't been this bubble it would have been some other. We went 18 years without a major recession and would have to go another two decades -- forty years, in all -- for things to work themselves out calmly. It's a pity, but that's the price of being too successful.

|

| Housing Bubble |

A briefer capsule of the housing bubble would describe how surplus funds in the banking system made it cheaper to lend out mortgage money, which soon led to surplus houses, which caused the prices of houses first to go up and then to go down, soon followed by the banking system, and maybe through banks to the rest of the economy. Stock speculation is easier to manage because houses take a very long time to disappear once you build them. Judging by the experience of the 1929 crash, it takes nearly twenty years for confidence to return after a bad crash, so perhaps the loss of confidence takes longer to recover than real estate prices. In fact, Europe looks as though it may take a century to recover its nerve, and by that time Europeans could be permanently in the dustbin of history. It can all be an unpleasant set of reflections.

Originally published: Wednesday, April 23, 2008; most-recently modified: Friday, May 31, 2019