Related Topics

Banking Panic 2007-2009 (1)

Mankind hasn't learned how to control sudden wealth, whether in families, third-world countries, or the richest nation in history. The world banking crisis of 2007 is the biggest example yet.

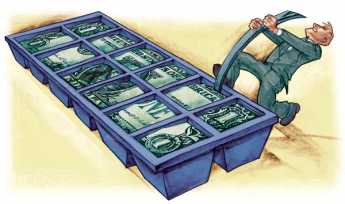

Frozen Markets

Markets cannot clear without transparency.

|

| Vikram Pandit |

Lots of people, perhaps far too many, borrow money. Many fewer are involved in the institutional lending of money, although still quite a few; but only a handful of those few have much familiarity with the mechanics of bank panic. Meanwhile, terms of art get propelled through the news media, accepted as established fact by almost everyone but placed in a peculiar storage category. Almost everyone knew the markets froze up all over the world; almost no one could define what was meant by that.

It meant that it was suddenly impossible to buy or sell financial instruments which normally are bought and sold by the thousands every hour. Some things were more thoroughly refrigerated than others, suggesting they were possibly at the heart of the problem, and some things took longer to thaw than others. One's grandparents could relate times in the 1930s when local towns had to pay their policemen and school teachers with a script because they could not obtain currency. So frozen markets could become serious, not just a day off from school. Basketball games and election campaigns continued to dominate the news, but deep within the newspapers markets continued frigid for quite a while, ominous and mysterious ice caverns.

|

| Abby Hoffman |

Many factors contributed as causes, and perhaps the greatest causes have not even been identified a year later, but two phenomena seem to explain a lot. The first was widespread reluctance to accept current market prices as realistic because no one likes to believe money is forever lost. The validity of market-based prices carries the assumption that weight of opinion will push prices in one direction or the other; if prices go too far, opportunists will push them back. Markets don't set prices, they "discover" prices by finding the price which temporarily balances the opinions of the universe of buyers and sellers. If you were Zeus, you might chortle at how wrong they all were, but nevertheless, the consensus "discovers" the price that clears the market. What Zeus thinks has nothing to do with it. The process of orderly matching of bids can come briefly to a halt for any number of silly reasons; Abby Hoffman once paralyzed the trading floor of the New York Stock Exchange by throwing dollar bills over the rail of the visitors' gallery, with a single hundred-dollar bill hidden among a lot of singles. Ramming an airplane into the building will do it longer, even for a while after the unexpected event is understood. But a lasting freeze-up is more likely to occur when the trading process unexpectedly drives all prices up or down, giving a signal that no longer is opinion equally divided, everybody is in total agreement that prices are going in a single direction, and no one, therefore, knows how high or low they are going to go. If everybody wants to sell, no one will buy.

Ordinarily, only a tiny sample of stocks or bonds are involved in daily trading, establishing a signal for what the rest --locked in banks or safe deposit vaults -- are worth. Most important are the inert securities "caught in a loan", being held as security for a loan on the presumption they are worth somewhat more than the loan. If the market abruptly decrees they are worth less than the loan, the bank will call for extra collateral, and failing that, will sell the collateral. When there are sudden runs in one direction or another, it becomes impossible to say what the collateral is worth; it's a good time to get out of the lending business if you can. Because no one dares buy, no one is able to sell; if you can't tell what the collateral is worth, no one will lend. That's pretty much what a frozen market looks like.

A variation of this concept arises when a banker refuses to sell because the emergency sale at a distressed price will "publish" a false price, which will then be applied to all of the rest of the bank's holdings, suggesting that those immense piles of securities in the vaults are really worthless. When distressed prices do surface, major banking concerns will refuse to acknowledge them as true prices. Because refusing to honor the "going price" is very disruptive, regulators force institutions to "mark to market" every day at the end of the day. If marking to market amounts to an admission of insolvency, that's unfortunate. A brokerage house forced into receivership because of obviously fallacious pricing can be even more bitter when it is recognized that commercial banks are not forced to mark to market, even with exactly the same securities. Banks are permitted to declare that securities are a long-term investment, marked on their books at the purchase price rather than the market price. Such maneuvering however gradually forces the bank out of the lending business at the same time that truly worthless paper is allowed to masquerade as sound securities. In the long run, it's bad for the economy, and in the long run, the bank goes out of business anyway, it just takes a few months longer. While this process is underway, the regulators will force weakened banks to issue more stock, thus diluting the value of the existing owners, a sort of punishment for improper management. Under the circumstances, a major incentive is created to avoid letting the world know how you stand. Transparency, as they say, suffers.

|

| Frozen Markets |

Repetitive Trading.In recent weeks, a professor at the Wharton School made a name for himself with theory with the power to become a law of the market place because of its power to explain some quirks. Repetitive trading in the financial marketplaces differs significantly from the market for used cars, say. If a single trade takes place for a high-priced item, the buyer and seller concentrate their efforts on getting that one price as favorable as they can; usually, the seller has superior information and more practice, so he sells for a profit margin over the real market price. Most customers hate this flea market. On the other hand, when two brokers make ten or twenty trades a day for months on end, they become valuable clients to each other. The value of sustaining the relationship is greater than the occasional opportunity to pull a fast one, so it becomes a fact of life that an imbalance in one direction will be compensated by a collusive imbalance in the other direction in some subsequent trade. Although an occasional customer may get a poor execution from his broker, the market as a whole is smoothed out and volatility is probably reduced. There's less stress and strain on the brokers in the middle of the trading profession, until one-day things go bang. Suddenly the value of the relationship seems quite minor compared with the potential for betting wrong in a congested market, that is, a stampede. So, such traders withdraw from the market as much as they can.

O'Neill's Parable Perhaps he oversimplified matters, but the 72nd Secretary of the Treasury of the United States certainly made a clear point about frozen markets. "Suppose," he said, "You imagine ten bottles of crystal-clear drinking water."

"Next, suppose someone suddenly announces the news that one of those bottles contains deadly poison. Nobody will buy a single one of those bottles, even though there is only a 10% chance that any one of them has poison. That's a frozen market."

Originally published: Monday, April 21, 2008; most-recently modified: Monday, May 20, 2019