Related Topics

Banking Panic 2007-2009 (1)

Mankind hasn't learned how to control sudden wealth, whether in families, third-world countries, or the richest nation in history. The world banking crisis of 2007 is the biggest example yet.

Sovereign Wealth Funds

|

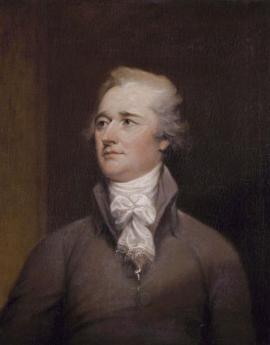

| Alexander Hamilton |

At Third and Chestnut Streets in Philadelphia there is a Japanese restaurant occupying the site where Alexander Hamilton once lived and devised the modern banking system. There's no historical marker, possibly because Hamilton's involvement in the Whiskey Rebellion and his political switch of the nation's capital from Philadelphia to the District of Columbia made his memory distasteful to local town fathers. It was at this place Hamilton devised the idea that what America needed most was a national debt -- national debt was a national treasure. Just about everyone was appalled, especially Thomas Jefferson and Albert Gallatin. George Washington didn't know about such things, but he trusted Hamilton and so we got a sovereign debt as a cornerstone of national finance because no one wanted to oppose Washington. Wrangling over this radical idea became a central issue in the next eight presidential elections. After that, we had a century of wrestling with substituting the Federal Reserve for precious metals as a way of controlling the money supply. In a more sophisticated form, our sovereign debt now forms the bedrock basis for the Federal Reserve's control of the banks and the monetary system. Just when things seemed settled, we confront something new and possibly just as revolutionary, the sovereign-wealth fund.

->If a country can have debt, it can have a surplus. Using that surplus to buy corporations was seen as nationalization, just a way- station on the road to socialism or communism. Somehow, what to do with national surpluses never became an issue, probably because it was easier to spend than to save. More recently, surplus funds have fallen to governments from oil or other natural resource discoveries, usually soon in the hands of a despot, combined with rudimentary banking systems that make it hard to invest locally. In 2008 these accumulations worldwide are estimated to exceed $3 trillion. Dubai has about $600 billion, and other countries like Singapore are not far behind. Traditionally, such funds end up in places like Switzerland where they more or less disappear from sight. While a few small countries have experimented with openly investing in stocks and bonds, the matter only surfaced as a real issue after the subprime mortgage mess of 2007. As a consequence of upheavals whose full nature is still obscure, financial giants like Citicorp, Merrill Lynch, and Morgan Stanley found themselves facing liquidation unless they could acquire billions of dollars by selling large blocks of their stock in a hurry. Thus the Americans, who would never contemplate their own government buying controlling shares of leading American corporations -- were jolted to see we had made foreign powers welcome to do so.

Furthermore, this might quickly get out of hand. The Chinese government, unashamedly communist, now holds 70% of American government bonds. Not only would a rapid bond liquidation be disruptive, but the purchase of corporations' controlling stock might be worse, The effective conversion of Wall Street into a street in Chinatown would have highly destabilizing consequences. Since holding vast quantities of bonds has created no problem, it would seem the main international difficulty lies in the voting power of common stock ownership. It might seem possible to prohibit sovereign foreign states from voting their proxies, although it is easy to imagine circumvention by straw-men. A more promising way to sterilize the voting power would be to forbid direct foreign nation ownership except through index funds. One questionable feature of this approach lies in the narrowing minority control which is created as index funds keep growing to a size that disenfranchises almost everybody except the management of corporations, or encourages predatory raids on a small sliver of outstanding listed stocks by promising future golden parachutes to CEOs and others who acquire stock by incentive options and then join in the raid.

Finally, it merits rumination about the growing vulnerability of banks, as agents of the Federal Reserve in its duty to stabilize the currency. The recent credit crunch delivered a setback to the securitization of debt, it is true, but nevertheless, the trend of several decades has been to weaken local banking. The eventual disappearance of banks is not inconceivable. Banks have consolidated into larger banking giants, but the recent troubles of Citicorp show that mega banking does not defend banks from securitization. We have to hope the Federal Reserve is considering responses to this threat to monetary management which are more productive than just a bunker mentality.

Originally published: Wednesday, February 27, 2008; most-recently modified: Wednesday, June 05, 2019