Related Topics

Banking Panic 2007-2009 (1)

Mankind hasn't learned how to control sudden wealth, whether in families, third-world countries, or the richest nation in history. The world banking crisis of 2007 is the biggest example yet.

Debt Rating Agencies

Three years ago, a gathering of bank executives were asked if they had an understanding of derivatives; it became instantly clear they hadn't the foggiest. More recently than that, Robert Rubin no less, admitted he first heard the term, credit derivative, a year earlier. When such an innovation means thirty or more $trillions quickly, it creates opportunities for quick learners. Everybody else relies on experts. But even if you grasp the credit derivative idea quickly, its innate complexity defeats you. Thousands of loans are jumbled together, shaken, diced and sliced, sold, and reassembled in new packages. The choice was clear: a banker must either decide to stay clear of such mysteries no matter how profitable they seem or else rely on the opinion of triple-A rated agencies of long and honorable standing. A great many people decided to go with agency opinion, combined with a determination to sell these things as fast as they got them. The agencies did their best with an almost impossible task, and the sales volume soared.

|

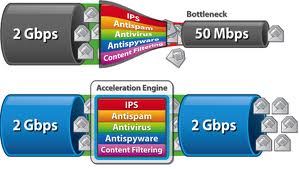

| bottleneck of computer |

In a computer age, such complexity can be quickly defined, traced from start to finish, evaluated in mass quantity, bringing final pricing decisions down to manageable form. But the bottleneck of computer programming limits the ability to address this rush job as quickly as its terms and direction are shifting. When computers catch up, much of this problem will come under control, without time-outs, new rules, or perplexing restraints. Meanwhile, the response emerged: keep as little inventory as you possibly can and meanwhile take a chance on the agency opinion. No doubt, other options were considered: play your cards close to your vest, position yourself to jump clear of trouble as soon as you hear of it. Billions, simply billions of dollars were to be made if you were quick and bold.

* * * * *

Naturally, this pretty crude approach becomes steadily safer as experience showed its strengths and flaws; in time it might even be replaced by an auction between counterparties, creating a market for price discovery. Or perhaps packaging firms would strengthen their own evaluations to a point where each firm's reputation could compete with the rating agencies in risk assessment. Nevertheless, the lack of feedback was crippling until computer programming caught up. Market participants demand reasonable correspondence between ratings and subsequent default rates. In the meantime, everyone flew by the seat of his pants. Unfortunately, in that meantime, everything blew up.

* * * * *

|

| Gaussian, or |

Mathematics contribute some insight into why it happened so soon. The Law of Averages forces a huge number of random opinions to assume a Gaussian, or "normal", distribution curve of rather narrow fluctuations. When opinions are constrained to a handful of rating agencies, however, volatility spread gets much wider, or "fractal". In the wry shorthand of market traders, a hundred-year probability then seems to occur every four or five years. Paradoxically, wide unexpected jolts are not caused by an increasing number of opinions, but the reverse. In investing circles it is said that the higher it goes, the more volatile it gets, and more likely to crash. "Chartist" observers notice this phenomenon in reverse; a period of declining volatility is known as a "pennant formation", often observed to precede a sudden reversal in market direction. Whether preceded by megaphones or pennants, when someone cries "Fire!" in a crowded theater, public opinions narrow down to only one -- get out the door.

Originally published: Tuesday, February 12, 2008; most-recently modified: Thursday, May 16, 2019