Related Topics

Favorite Reflections

In no particular order, here are the author's own favorites.

In no particular order, here are the author's own favorites.

Six Ways to Fix Social Security

|

| Health-Care Python |

Baby boomers, the so-called pig in the python, are right to worry there may not be enough money to pay their promised Social Security benefits. Everybody else is a little suspicious that former Flower Children and veterans of Woodstock might somehow be responsible for their own problem. That's quite a bum rap. If you must blame someone, blame Lyndon Johnson for half of it, and the medical profession for the other half.

Although the original design of Social Security during the Roosevelt administration had the shaky arrangement of each generation paying the costs of its parents, rather outrageously dubbed "pay-as-you-go", the true weakness of assuming all generations would remain of equal size only appeared when Lyndon Johnson put it under stress. In seeking a way to portray Medicare as comfortably financed, Johnson combined Social Security savings with the general budget, a process he termed a "Unified Budget". In fact, the savings of the baby boomers were promptly spent for current expenses, including earmarks, along with more benevolent expenses. One has to marvel that a protest generation of Boomers once led by Jerry Rubin and Abby Hoffman, has been so supine about being swindled out of lifetime savings.

|

| Bill Clinton |

The medical profession deserves blame for the other half of the impending problem. Life expectancy at birth has increased twelve or thirteen years during the working lifetime of the boomers, probably will increase by a year or two more by the time the last of the boomers retire in 2030. If we find a cure for cancer, life expectancy will probably jump five years. Such astounding medical advances had never before happened, so it is fair to forgive a lack of foresight in the original 1933 calculations. Originally, the average age at retirement was 67 and the average age at death was 69, two years of average retirement to provide for. Unfortunately, the average age at retirement dropped to 63, and the average age at death rose to 77. You might scorn the boomers for retiring two years sooner, but the other added years of longevity are mostly nothing to weep over.

There might be other, still more clever, ways to rescue national finances from this predicament, but a careful reading of the news only identifies six proposals that anyone has told us about. They are as follows.

1. The Lockbox. Bill Clinton seems to have been saying we ought to repeal the Unified Budget and actually save the retirement savings instead of spending them. Indeed we should, but it's a little late, getting later. Republicans in Congress would probably vote for it, but not without drawing a lot of attention to the fact that Lyndon Johnson never should have proposed the Unified Budget in the first place.

|

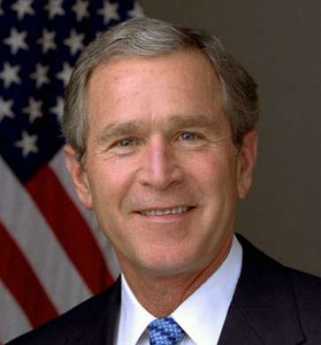

| George W. Bush |

2. Privatize it. George Bush took the understandable position that government has demonstrated it cannot be trusted to save money, so give it to the individual to save. Some won't, of course, but at least their subsequent problems will be their own individual fault. And the victims would be individual rather than a whole generation. Perhaps an even stronger concern is that a great many financially naive people could be swindled by mutual funds with outrageous fees and poor performance. Presumably, a law could be technically crafted to minimize this risk, but it would have to survive a great deal of lobbying to be usefully intact at the end of it.

|

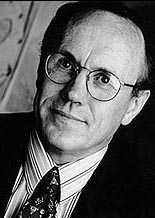

| Ed Prescott |

3. Borrow it. Nobel laureate Edward C. Prescott is on record saying more debt would be nothing to worry about since an ideal federal debt should be 2.0 times the Gross Domestic Product, whereas it is only 1.6 times GDP at present. If we really think it best to continue intergenerational borrowing, debt is a pretty inevitable consequence. Most of the nation is however more familiar with Polonius on the subject, that borrowing dulls the edge of husbandry, and a skeptical public would need far more convincing than by the mere use of computer modeling. For example, what if we acquired the debt and then GDP should fall in a recession. Once created, it's hard to see how to reduce the debt to maintain the 2.0 ratio. If you couldn't, you might experience the Weimar Republic again, with inflation going to destructive levels. Neither borrower nor lender be.

4. Tax the Rich This political slogan is apparently intended to support raising the income threshold (now approaching $100,000 yearly income) above which the 12.4% tax is applied. Quite aside from political class warfare that might be provoked, and a disincentive for workers to work, there is only a questionable net revenue enhancement. Raising the ceiling for contributions implies raising later benefit payouts, with lessened or no net saving on behalf of the baby boomer deficit. To achieve a net revenue gain, there would have to be a new feature: taxation without benefit.

5. Raise taxes. Presumably, the Republicans would burn at the stake rather than allow taxes to rise, now that the harm to the economy seems fairly well established. Taxes would then effectively be raised on the present working generation only because previous Congresses had been unwilling to raise taxes on earlier generations. Quite aside from the unfairness outcry, there seems little doubt we are on a point of the taxation curve where small increases in taxation would have rather prompt negative effects on the economy. Once a recession appeared, the political consequences for triggering it might be dire.

6. Increase the age of retirement. This is my favorite solution. Having retired at age 80 myself, actuaries still promise me fifteen years of an extended vacation, so people like me perceive no great hardship in future generations retiring at age 70. Even inducing people to retire at the age of 67 as they did a generation ago, would help the problem a lot. There once was a time when we advised young people not to get married until their financial ship came in. Perhaps the new advice is, don't retire until you can afford to do it.

Congressman Pence (R-Indiana) has a related piece of advice. It takes a long time for public adjustment to something so radical and important to them. The Congressman advises us to do nothing at all for two years, using the time to build a case, and create a national consensus that whatever we do is the best that can be done. That seems like rather sensible advice, Congressman.

Originally published: Wednesday, January 24, 2007; most-recently modified: Wednesday, June 05, 2019

| Posted by: Dr. Fisher replies | Feb 21, 2007 3:14 PM |

I recommend this series very highly even though it was recorded in 1996-7 and is in some ways out of date and does not consider the great crash of 2000 or the great folly of the Bush Administration.

Taylor considers Social Security at length and he concludes, aside from the obvious idea that taxes must go up and/or benefits must fall,

1. Eliminating the ceiling on social security taxation would extend the program's life considerably

2. and adding the "2% Solution" (increasing the tax by 2%, 1% for the employee and 1% for the employer) would push the problem well beyond the current 75-year planning horizon.

| Posted by: G4 | Jan 25, 2007 7:28 PM |