3 Volumes

Constitutional Era

American history between the Revolution and the approach of the Civil War, was dominated by the Constitutional Convention in Philadelphia in 1787. Background rumbling was from the French Revolution. The War of 1812 was merely an embarrassment.

Health Reform: Children Playing With Matches

Health Reform: Changing the Insurance Model

At 18% of GDP, health care is too big to be revised in one step. We advise collecting interest on the revenue, using modified Health Savings Accounts. After that, the obvious next steps would trigger as much reform as we could handle in a decade.

Obamacare Follies, Executive Summary

Obamacare needs simple explanation

Only Three Things Wrong With American Healthcare

|

| American Healthcare |

Although Congress is offering several thousand pages of proposals for healthcare "reform", none of them even mentions the three main difficulties, to say nothing of fixing them. Let's be terse about this:

1. Health insurance is fine, but if you make it universal, there is no impartial way to determine fair prices. Somebody must haggle with the vendor in order to introduce the issue of what is the service worth? The customer doesn't care what it costs to make, or whether the vendors are being paid fairly. If everyone is insured, no one cares what it costs. Not only do all costs rise, but they rise without coordination, without a sense of what each component is worth, relative to alternatives.

2. Employer-based insurance is fine, but it ends when employment ends. You just can't stretch employment-based insurance because you can't stretch employment.

3. State Medicaid programs are fine, but just about all fifty states are going broke trying to pay for it. Extending it to more people by raising the income limits just makes things worse. Items 2. and 3. are related. Trying to do both -- expand Medicaid as employment shrinks -- during a recession is incomprehensible. Item 1. (price confusion) gets drawn into this because the States try to pay less than it costs, hoping to shift the deficiency through hospital cost-shifting, utterly confounding the information which prices provide. The doctors have no way to tell which is the cheapest approach to a problem, so they don't try. Without control over prices, we can only control volume.

That's really all there is to this mess. Not one word of the current legislation even mentions these problems, so of course the legislation blunders. Even a child can see that compulsory expansion of benefits to universal coverage will fail if you can't pay for what you already have. No one will make sacrifices for a new system if the sacrifices seem futile. They are futile, so leave me alone.

The current administration has been compared with bank robbers who see they are trapped and decide to shoot their way out. Let's see them try to shoot their way past the first Tuesday after the first Monday in November.

Taxes as a Form of Consumption

About half of the American public pays federal income taxes, and among the half who don't, a great many receive a green government payment check, meaning they have negative income taxes. The tax assistance companies, H. and R. Block and the like, had little for their offices and staff to do in January, February and March until someone hit on the idea of processing "fundable tax credits" for a fee. That is, the lower-income segments of the population get the promise of an April tax "rebate" as the consequence of tax-form preparation, so H. and R. Block just loans them the money, discounted for fees and interest. It keeps staff busy, generates revenue. Hardly anyone in the upper income half of the population is aware of all this, so there is little political friction. This whole system of income redistribution quite effectively keeps the two halves of the population sitting in the same chairs at the tax-preparation offices, but in different months of the year; one half getting paid, the other half coughing up the payments.

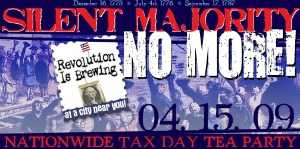

It thus becomes possible for two inflammatory slogans to bandy about, without starting fistfights or revolutions. The first was overheard at a local bank, one stranger remarking to another, "Has it ever occurred to you that taxes are a form of consumption?" To which the other person replies, "Yes, and taxes are the largest expenditure I make." A nation which once went to war over a two-cent tax on tea is remarkably passive about the ways things have evolved, but this essay is not devoted to unfairness. Prepare to hear how the upper income brackets might reduce their taxes, whether that counts as decreased consumption or not. Whenever you tax something, you get less of it; if you tax public income more, the public will earn less. So, this little essay is serious when it proposes that we all earn less, so we can get taxed less. And being taxed less, we need save less for our retirements.

The general principle is this: income is usually taxed in the year it is earned, with some exceptions, rebates and deferrals. The exceptional situations are often referred to as "loopholes" and therefore live in political jeopardy. However, if a person spends the money or dies while these deferrals continue to exist, the income may escape taxation entirely. In a sense, the largest loophole of all lies in the present fact that nearly half the population pays no income taxes at all, so saving income earned under those circumstances may lead to investment capital, which is later spent during highly taxed periods of that same person's life. Money earned by a child, usually on investments donated by a relative, is an example. Since at present, a child may receive annual gifts of $13,000 tax-free, as much as a half-million dollars can be accumulated in this way, always at the risk that laws may be changed and, further, at risk of spendthrift abuse by a psychopathic child. Whether these are wise risks for a parent to take, depends in large part on what sacrifices are made for the purpose, especially loss of parental restraint of unwise spending. A much more serious argument grows out of the possibility that money in the hands of children who lack experience in deferred gratification may actually provoke recreational drug use, or other sociopathic behavior.

Finally, lack of planning may create opportunities as much as planning does. A person who has paid little attention to financial planning may arrive at an advanced stage where life expectancy is considerably shorter. Savings at that point may be divided into money on which deferred taxes must be paid when you spend it, and money on which taxes have already been paid. More savings will be consumed if the individual triggers deferred tax liabilities, than if he just uses up money on which taxes have already been paid. Therefore, if he ignores lifetime habits and spends after-tax capital first -- the whole nest egg will last longer. But none of this deferred-income tax issue can compare with the problem of income on which taxation has been completely forgiven at the time it was spent, the so-called tax expenditures. The largest such tax expenditures are on the interest of home mortgages, on employer-paid (but not self-paid) health insurance, and employer-paid retirement income. Of these, the least consequential are the retirement income, because the tax is merely deferred, not completely forgiven. The two biggest items are home mortgages, which lie at the root of the 2007 financial crash, and employer-paid health insurance premiums, which triggered the Obama health proposal of 2009. The Obama plan purports to rein in health costs, but is estimated by the Congressional Budget Office to cost the Treasury $100 billion a year.

Extra! In the Fall of 2011, this boring matter suddenly came to the surface, in the form of huge American deficits threatening to bankrupt the country, as they were apparently actually going to do in Greece. As politicians do, many attempts were first made to rename the over-spending issue for partisan advantage. It was, for instance, tax expenditure. It was, possibly, a sovereign debt crisis. In any event, the Congressional Budget Office included such wealth redistribution under the heading of tax expenditure, which totalled a trillion dollars. Since everyone was searching for a painless category to eliminate in order to balance the budget, this term was hard to avoid. As far as Congress is concerned, the national deficit is whatever the CBO says it is, and in this case it lumped a lot of things together which politicians would like to split apart. When you take things in small pieces, it becomes possible to boil the frog by slowly heating it up before it realizes it is cooked. Lumping things together induces the frog to jump out of the pot, but however that may be, it has got lumped together by the referee of such matters, and there is a strong possibility it will stay lumped.The essential point for accountants to focus on, is that tax expenditures are all counted as revenue when any non-accountant can see they are expenses. For political speech-making purposes, this distinction is vital and no opponent will let another politician wiggle out of it. And the beauty part of it is that it also spotlights three of the most besetting evils of modern politics: the tax exclusion of employer-based health insurance, the home mortgage interest tax exclusion, and the "earned" income tax credit. The first of these is responsible for our health insurance mess, and the other is responsible for our home mortgage crisis; the two main political problems of the day are suddenly plopped into the limelight, just when a lot of people are looking for ways to hide them. Furthermore, this bombshell was fired by a panel of the four outstanding tax economists of the nation, each of them roundly denouncing them as unthinkable ideas that never should have been born in the first place. Alan Greenspan, famous for unintelligible speech, simply said all of these tax expenditures, every one of them, should be eliminated immediately. One would hope that is clear enough. Martin Goldstein, formerly chairman of President Reagan's Council of Economic Advisors, agreed. As did former Governor Engler of Michigan, widely acknowledged to have rescued his state from impending bankruptcy. Senator Nelson, a Democrat from Florida and chairman of the committee, positively beamed with pleasure. It was hard to think this was anything but a turning point in history; let some political candidate disagree, and he can expect to have his audience shown a videotape of this succinct epic in the history of Senatorial hearings. These greybeards said, in what was obviously an unrehearsed moment, just eliminate these three terrible ideas in one stroke, and the national deficit will be reduced by a trillion. That's what they said, and it's easily proved that they had said it.

Obamacare's Constitutionality

|

| President Barack Obama |

Any idea of a smoothly orchestrated introduction of the new law was jarringly interrupted by the U. S. Supreme Court, which granted a hearing to a complaint by 26 State Attorney Generals, that the ACA Act was unconstitutional. It was big news that the whole Affordable Care Act might be set aside without selling a single policy of insurance. The timing (before the Act had actually been implemented) served to guarantee that the constitutional issue, and only that issue, would be discussed at this Supreme Court hearing. By implication, there might be more than one episode to these hearings.

While many could have declaimed for an hour without notes, about difficult issues perceived in the Obama health plan, questioning its constitutionality had scarcely entered most minds. Then of a sudden, near the end of March 2012, a case testing the constitutionality of mandatory health insurance was granted certiorari and very promptly argued for three full days before the U.S. Supreme Court. Twenty-six state attorneys general brought that case, so it was not trivial. In jest, one Justice quipped he would rather throw out the whole case than being forced to spend a year just reading 2500 pages of it. But Justices are practiced in the art of quickly getting to the heart of a matter; it soon boiled down to one issue: was it constitutional for Congress to force the whole nation to purchase health insurance? Is there no limit in the Constitution about what the federal government can force all citizens to do, even though the federal government itself is severely limited in scope? Even though the Tenth Amendment states that anything not specifically granted to the federal becomes the province of the states? Would a people who fought an armed revolution for eight years over a 2-cent tax on tea, now consent to a much larger requirement which it was not constitutionally authorized to impose? Most people finally wrapped their heads around some formulation of this non-medical concept to a point where they vaguely understood what the Judges were arguing about. This was beginning to look like a topic where We The People made a covenant with our elected leaders, and reserve the sole right to change it.

The powers not delegated to the United States by the Constitution, nor prohibited by it to the States, are reserved to the States respectively, or to the people.

|

| Tenth Amendment |

The Constitution describes a Federal system in which, a few enumerated powers are granted to the national government but every other power is reserved to the state legislatures. The Constitution had to be ratified by the states to go into effect, and the states had such strong reservations about the surrender of more than a handful of powers that they would not ratify the document unless the concept of enumeration was restated by the Tenth Amendment. If states could not be persuaded of the need for a particular power to be national, they might refuse to ratify a document which enabled permanent quarrels about the issue. That wariness explains why The Bill of Rights goes to the extra trouble of declaring certain powers are forbidden to any level of government.

Separation of powers further explains why Mr. Romney's mandatory health insurance plan might be legal for the Massachusetts legislature but prohibited to Congress. After Chief Justice Roberts got through with it, whether that truly remains the case will now depend on whether it is described as a tax, a penalty, a cost, or whatever, and only if the U.S. Supreme Court later agrees that was a proper definition. Because -- to be considered a tax it must be too small to be considered coercion. The law itself apparently does not underline this distinction in a way the Justices felt they could approve. Indeed, while Mr. Obama in his speeches firmly declared it was not a tax, later White House "officials" declared it might be. There was agreement the Federal government could tax, but no acknowledgment that taxes might have any purpose other than revenue.

Under circumstances widely visible on television, however, it was clear that the House of Representatives had been offered no opportunity to comment on this and many other points in this legislation. To a layman, that fact itself seems as clear a violation of constitutional intent as almost any other issue, since the Constitution indicates no idea was ever contemplated that any President might construct laws, nor like the courts, interpret their meaning. The first three Presidents repeatedly raised the question of whether they had the authority to do certain things we now take for granted. And Thomas Jefferson was similarly boxed in by a clever Chief Justice, who said, in effect, Agree to This Decision, or be Prepared to Get a Worse One. The Constitution says it is the function of the Executive branch to enforce the law, "faithfully". Presumably, all of the thousands of regulations issued by the Executive Branch under this law must meet the same test.

Given that the Justices now hold it constitutional for the federal Congress to mandate universal health insurance, based on some authority within taxation, the immediate next issue is paying for it. Millions of citizens, usually young and healthy but sometimes for religious reasons, do not want to buy health insurance and would be forced to do so by this law because the only available alternative is to pay a revenue tax. The purpose of including them is to overcharge people who will predictably under-use community-rated insurance, and thus enable the surplus to reduce costs for those who do want to buy health insurance. (Here, the Court had the pleasure of reducing an unusually opaque law to an unusually succinct summary.) To avoid the charge of a "taking", the Administration must either surrender on the universal mandatory point or else surrender the level premiums of community rating. The lawyers for the complaining attorneys general laid great stress on this particular issue in their arguments, and it occasioned much of the discussion from the bench. However, until the law is in action there is as yet no cause for damages.

Here it will depend on whether you call it a permissible activity for Massachusetts or for the Federal government. The Constitutional point seems to be that it is a legitimate Federal power to tax for the "general welfare", so it now becomes essential to know if the taxes for noncompliance in Obamacare are really a penalty. The Justices seemed to be questioning whether the whole scheme would collapse with the forced subsidy eliminated, and because of that be deemed to have been a "general welfare purpose" adequate to meet the constitutional requirement of a permissible enumerated purpose. Lawyers can generally find such a defined purpose in the words of the Constitution, even if they have to dip into the penumbras and emanations of the words. So the question might just devolve into whether a majority of the Justices wish to declare the penumbra to be within the enumerated powers of Congress. To all of this, the lawyers for the attorneys' general reply that such an enumerated power is impossible because there is no limit to what could be done by this method. Congress would then be allowed to mandate that everyone eat broccoli for dinner, or buy a General Motors car in order to pay for the deficits of rescuing that company from bankruptcy. Almost anything could be mandated by establishing a penalty called a tax; including a mandate that everyone buys a product in order to pay for the deficits of mandating it, illustrates there exists at least one circularity of enumerating something like a power of Congress. According to this reasoning, mandated health insurance cannot, therefore, be an enumerated power of Congress, either now or at any time in the future. The sort of speculative law outlined in this paragraph is exactly the sort of thing the Supreme Court dislikes and shows the utility of denying access to the courts to anyone who cannot claim "standing", defined as a claim of actual injury from a law.

The Justices undoubtedly had to weigh the fact that the American public has a strong distaste for this sort of convoluted reasoning, which sounds like a convention of Jesuit priests having fun. On many other occasions, however, the public has accepted the judgment of people it hired to understand this sort of thing; that's called respect for the law. Eighty years ago in the Roosevelt court-packing case, there was the same sort of collision between the Court and the President, and the Court knuckled under even though the public supported the Court. In both cases, the Court seemed to be yielding to the President, with the unspoken compromise that the President would not pursue his earlier course with quite so much vigor. Since the really central 1937 question of overturning the Interstate Commerce clause ("Commerce among the several states") was left unaddressed, the velvet glove might yet contain an iron fist.

An Unending Capacity to Generate New Problems

There is a fair amount of seemingly unrelated detail until we reach the point of this article, where we conclude it really is possible to design and pay for lifetime health costs with the tools we already have, using individually owned lifetime policies. As a part of that, it really should be possible to substitute cost shifting between the youth and the old age of one person, rather than the present kind of cost shifting from one person or group to somebody else. People don't mind taking from one of their pockets and putting into a different one. But fierce possessiveness appears when you shift from my pocket to your pocket, and the health system is riddled with it. "Riddled with cost-shifting" seems to imply underhandedness. In fact, only the simplest businesses could survive without such flexibility. The problem with cost-shifting in medical care is there is so much it, even carried to the extreme of performing carefree, with blithe indifference about how to pay for it. Just review how accustomed we have become to cost shifting as the only possible thing to do.

From the outset, Blue plans announced their business model: patients in the private rooms supporting the care of indigent patients on the wards, up to then entirely supported by the charity. Plus a third, intermediate class of say ministers and school teachers, called semi-private, who were financed on a strict break-even basis. Summary: rich people supported poor people, and the semi-privates broke even. At first, there was just a handful of semiprivate, but after a decade or so, just about everybody was semiprivate, defined as two strangers in a room. Blue Cross had an enormous unintended effect on hospital architecture. When Medicare and Medicaid adopted the same philosophy, the semiprivate room became the standard. If the rooms were small (and cramped) the nurses didn't have to walk so far, but the main driver was the insurance reimbursement formula, which was based on square feet of floor space. A square foot of such space was used as a cost basis for non-patient space in the overhead formula. Eventually, hospital architects were receiving demands for bizarre room sizes, in order to affect the reimbursement formula. The tail was beginning to wag the dog.

t During that era, charities were payers of last resort, unless creditors were stripped by bankruptcy. Furthermore, to provide a full range of services, some services lost money, subsidized by other departments which generated a profit. Any corporate executive could tell you what came next: the profit centers start to boss the losers around. In group practices, surgeons generally still subsidize primary care ("the feeders"); state Medicaid is roughly 50% subsidized by federal Medicare, and after hospitals are paid, underpayment by Medicaid is balanced by the hospital from other sources, once again mainly from Medicare until payment by diagnosis (DRG) came along. It is when one insurance competitor is forced by internal hospital cost-shifting to subsidize its rival, that most of the outcry is heard. Employer-basing leads to different subsidies between insurances, and by a two-step process, one competitive business subsidizes its fiercest competitor. Generally, a business does not care what things cost, so long as competitors must pay the same price. In the eyes of business, trouble comes from unequal cost-shifting. Its mere suspicion is almost as bad. Working-age people subsidize the generations too young or too old to work. That is obviously what must happen indirectly and unofficially, anyway. Cost-shifting is a normal business practice, an absolutely necessary one, but the cost shifting of hospital costs is almost beyond belief. Because now, no one can tell what anything costs, and because patients who are business employees will reflect the attitude that the absolute amount doesn't matter, only that competitors must pay the same. In short, cost rises meet little resistance.

What brings the matter to a crisis is payment by diagnosis, where it doesn't matter how long a patient stays or how many tests he has, the insurance payment to the hospital is the same. Added to a determination by Medicare to cut costs, the result is that the profit margin for inpatients is around 2%. From the payment designers' point of view, it's an excellent rationing system. But it isn't, because hospital architects are directed to shift their lavishness to service areas with greater profit margins, like emergency rooms and satellite outpatient clinics. The next time you see a building crane at your local hospital, just ask them what kind of building they are putting up. Having spent a fortune twisting hospitals into one kind of shape, the reimbursement system is twisting a new shape, and rather oblivious about it. At the same time, two-bedrooms are being converted to one-bedrooms to attract a carriage trade and justify a higher price. Maybe, just maybe, the bed capacity is somewhat smaller at the end of responding to a pitiful profit margin for inpatients. Changing demographics are also a factor. Trends toward unsustainable cross subsidies grow steadily larger because the contribution of working people is certain to get proportionately smaller. Extended longevity increases the proportion of young and old dependents, boosting the costs of working people by the fact that their shrinking proportion must ultimately pay for all of it. Ultimately, all hospital revenue originates with the working segment of the population. Parents pay for their children, and payroll deductions pay for the elderly grandparents. Working people are supporting it all. Let's not overstate: disappearing infectious diseases reduced the mortality and hospitalization of working people, too. The elimination of polio and tuberculosis was a dramatic godsend but made it harder to finance a general hospital, because of the shrinking client base of employed people. The way things are going, health costs should eventually concentrate in the first and last years of life, with hardly any serious illnesses for the people in the middle years of life who ultimately pay for every bit. Hospital cost-shifting can not indefinitely support its own system because working people will have so few medical expenses it becomes impossible to hide very much within them. If you want to know why payment by diagnosis was welcomed, just reread the last three paragraphs. Unfortunately, if payment is based on diagnosis, it doesn't matter how many x-rays you have, or whether all the door handles are polished brass. We badly need a new way to charge inpatients, and just about every system has been tried. Unfortunately, it took a long time to get rid of payment by the square foot, and it will take a long time to get rid of payment by two hundred very approximate diagnosis groups, or DRG. The very least that could be done is to substitute a better diagnosis code, like SNOMed, for the private ICDA, so that payments are seen to be driven by the right diagnosis, which might tell planners something useful.

How could we have created individual policies that failed to reward customer loyalty with guaranteed renewal? Or monopoly status, to companies without guaranteed issue?

|

| Lost Opportunity |

Medicare would pay terminal costs as before, but be reimbursed by the escrow fund.

|

| Transfer Vehicle |

Malpractice costs are disproportionately concentrated in Obstetrics.

|

| Who is doing the suing? |

The second redirection of attention would be to campaign to lower the age at which American women have their first child, greatly reducing neonatal problems, including infertility measures and congenital malformations. Absorbing the cost of having a baby ought to assist this effort, otherwise highly desirable on purely medical grounds. Unfortunately, our system of graduate education and career advancement will incentivize timing conflicts with biologic goals. Society will have to work these conflicts out in its own way, but at least we can adjust health insurance timing to be more in keeping with societal trends.

Finally, it should be said that the Health Savings Accounts are a vastly simpler way of paying for health care than using the service benefits approach, and the payment system greatly needs simplification. Using a high deductible has the potential to preserve market benchmarks for prices which are otherwise going to induce unworkable price controls, permanently. The system of "first dollar coverage" was accelerated by a wish to include as much as possible under the Henry Kaiser income tax evasion, and it will return if we neglect to correct that flaw. Experience with Health Savings Accounts has demonstrated as much as a 30% reduction in claims costs. Linking market-set outpatient costs to the same services when provided to inpatients should be an adequate price control for helpless sick people since an improved system of diagnosis-related groups should accomplish most of it. But the main advantage is to reduce these fund transfers to money without health attachments, to make unification and substitution more plausible. That is, to eliminate "service benefits" and not replace them with "diagnosis benefits" except for helpless bed patients. A return to dollar indemnity is greatly needed, although perhaps not totally.

To a considerable degree, service benefits are in conflict with indemnity benefits, in a manner resembling the conflict between debt and equity in the financial sphere. At some point, there must be a reconciliation between these two ways of paying for things, especially by keeping indemnity consistent with market prices. The best one can hope for is to shift the location of the interface between service benefits and indemnity, bringing the friction out into public view, and equalizing the power of the sponsors. Therefore, the best place to hold the debate is to treat diagnosis groups as inpatient service benefits, and outpatient costs as indemnity. With reasonable exceptions, of course. One of the main mistakes of the DRG system was to extend it to every inpatient. Inpatient psychiatry should be paid for as if it were an outpatient service, and chronic diseases such as Alzheimer's disease should also be excluded from DRG as well. Emergency room visits should be separated into two groups as well (admitted to hospital and discharged home), with reimbursement slanted to reduce the incentives for unnecessary use of the Emergency room, not the other way around as it is at present. The whole trick here is to see the double reimbursement situation as an opportunity for constantly rebalancing the two approaches, rather than allowing it to be pounced upon as a loophole.

We started by saying these issues should be chipped away, during the period when more important issues are being addressed head-on. But the list of small issues is a long one, providing ample opportunity for trade-offs in ambiguous opportunities. More than anything else, the endless capacity to develop new problems demonstrates the need for careful construction of an institution to serve as an informed and trustworthy umpire.

Cost Shifting, Reconsidered

|

Cost-shifting is a necessary accounting evil, without which no large organization could survive. Confusingly large amounts of it, however, undermine trust in the leadership. More specific criticism of current healthcare leadership is its reliance on moralizing rather than an apology. That is a sure sign that oppressors (i.e. insurance and government) made it necessary, and suggests that leadership is toadying to them.

Since managers have no choice but to engage in cost-shifting, it seems better to cost-shift with some hope of repayment. By switching to lifetime health insurance to replace the one-year version, many more opportunities can be developed for repaying the older individual what had been "borrowed" from him as a youth. Even without the notion of paying interest on the loan with investment proceeds, it seems more comfortable to seek loan forgiveness from yourself at a later stage of life, if that proves the necessary insurance metaphor.

The proposal to revise insurance architecture also contains a transfer of the site of cost-shifting from hospitals to the external insurance mechanism, where the underlying problems originated. There is a certain justice to that, but its main attraction is to make it visible and consensual, and therefore more generally accepted. It is one thing to convince a classroom of business students, quite another to convince the whole public, of the regrettable need for cost-shifting that will never seem completely fair.

And finally, there is the investment income. The public is no more likely to forgive its mercenary features than it is to accept that bankers are interested in more than profits from the interest on a loan. After all, interest-bearing loans were forbidden by law for centuries. When it first hears of the fairly astonishing 10% return from a passive investment, and the even more astonishing sums to be derived from ninety years of investing, the public will likely scoff at some sort of trickery. A great many people still prefer managed accounts to passive ones, in spite of Professor Ibbottson's rather convincing data from the immediately preceding century.

Two sources of concern are nevertheless impossible to answer. America may lose its dynamism, as even the Roman Empire eventually did, and nothing can withstand the financial consequences. And secondly, so many people might switch to passive investment that it loses its edge, and eventually pays less than hiding all savings in a mattress. That is to say, high returns imply high risk; without risk, there will be no returns. These considerations are long term and have nothing to do with healthcare. For this reason, I have reluctantly made the suggestion that we establish an independent organization, for all its flaws, to study whatever is happening and continuously make mid-course corrections to adjust for it.

| Posted by: how to get facebook fans free | Feb 13, 2012 9:53 AM |

| Posted by: cheapostay | Feb 13, 2012 9:31 AM |

5 Blogs

Only Three Things Wrong With American Healthcare

What needs to be fixed in American healthcare can be very simply stated as three fundamental problems.

...

What needs to be fixed in American healthcare can be very simply stated as three fundamental problems.

...

Taxes as a Form of Consumption

Most people find taxes are their biggest expense. Why not reduce them?

Most people find taxes are their biggest expense. Why not reduce them?

Obamacare's Constitutionality

Obamacare's constitutionality was argued before the U.S. Supreme Court in late March, 2012.

Obamacare's constitutionality was argued before the U.S. Supreme Court in late March, 2012.

An Unending Capacity to Generate New Problems

New blog 2013-06-11 13:51:10 description

Cost Shifting, Reconsidered

New blog 2013-07-16 16:55:35 description

New blog 2013-07-16 16:55:35 description