Related Topics

No topics are associated with this blog

Nudging Medicare into Retirements

Let's go straight to Medicare. We plan to add to it, not eliminate it. To make things more palatable, the changes we make should be voluntary. First examine the premise that protracted longevity is a direct consequence of improved healthcare, and should be considered one of its legitimate costs. Therefore, there is no betrayal of the promise to pay for healthcare within expansion to include retirement costs in Medicare. The problem is not that retirement cost is legitimate, but that we never saw any means to pay for it. I'm suggesting success in healthcare has led to the possibility that future cures may save money. The cures will first cost money, but as a disease is conquered, the former cost of treating people can be converted into money to pay for their extended longevity. And by the way, patents will run out, the competition will lower prices. Somewhere in the future, prices will come down, and we might gradually find the money to pay for retirements. We don't know how long it will take, but the NIH is currently spending $33 billion a year, trying its best to make it happen.

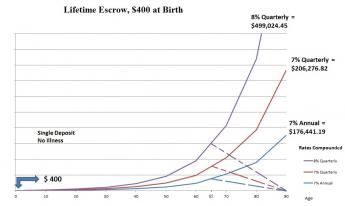

Furthermore, transaction costs on Wall Street have fallen by 70% in ten years. Index funds have made successful stock market investing feasible for amateurs, so long as they don't pay their agents' too many fees for it. Interest rates on savings have become trivial, but the safety of common stocks has vastly increased. The bond market is a disaster, so it's to be avoided. Although the average citizen is scared to death of stocks, they are about all that is left. But that's enough if you are careful picking your agent. Where does the seed money come from? Well, it's called a wage withholding tax, it's 3% of earnings (half of which is often paid by employers), and the public has long since quit asking what is done with it. Without venturing into that quagmire, suffice it to say it is available if you can apply political muscle. And compound interest makes it grow into quite an appreciable sum in a reasonable period of time. Remember, the worker starts contributing it around age 25, and doesn't die until he is (on average) 84. For illustration, let's divert $400 to this purpose, and see how it would grow (tax-free) from his birth to death at age 90. These are assumptions for illustration, but longevity might well grow from 84 to 90 by the time it matters for most young people. In other places, we will go into how we got the estimate of 6.5% returns, and how to get started at birth.

The first graph shows several things, but the main one is that such a manageable diversion of $400 will lead to $ 206,276.82. That's almost enough to supply a pension of $20,000 a year, which would be $40,000 for a couple. In addition, it would pay for the last year of life, reducing costs for everybody, including the government, whose loans make up present shortfalls. Nice.

|

Now, the hard part. How do you start at birth, and earn 6.5%? In the first place, dividends are issued quarterly, and there is a considerable drop in income if you accept annual compounding. Secondly, 7% was selected for convenience in doing estimates in your head; the real interest rate is 6.5% and you won't get that without an argument, maybe without a law. Finally, we start at birth because we are projecting a contingency fund, not the real transfer. The first time around, this would have to be a government subsidy, after that it would generate itself. So, a more realistic curve would look like this, starting at age 25 and generating 6.5% returns:

We hope the graph brings home the enormous power of increasing the interest return by fractions of a percent (consequently, the power of eliminating transactions fees, one of which is to buy and never sell, and the other is the power to transfer your account to a different broker). Furthermore, the compound interest curve is J-shaped, so increasing the length of time for it to work is also critical. Almost all of these steps require Congressional cooperation.

Finally, we draw to your attention that the proceeds are supposedly used to pay the last year of life costs back to Medicare. In fact, we hope to tap this source for other projects, too. What's more, we are counting on this addition to create the same incentive for Medicare recipients to be frugal spenders, just as it seems to have done with Health Savings Accounts. We believe this was an important incentive, but you can't be sure. And finally, while a fund growing to the time of death generates much more money, if you start paying pensions at age 65, it will start to shrink.

Originally published: Wednesday, May 25, 2016; most-recently modified: Tuesday, April 30, 2019