Related Topics

Introduction: Surviving Health Costs to Retire: Health (and Retirement) Savings Accounts

New topic 2016-03-08 22:42:53 description

Re-shuffling Some Old Ideas

Dear reader, please bear with the next three paragraphs. There's nothing entirely new. All of these ideas have been around for a long time, but are reshuffled into somewhat surprising recombination. We assume the reader has accepted our brief excursions into compound interest, escrow accounts, the J-shaped lifetime health expenses, and the complexities of pre-paying the cost of newborns. Our whole economy is built on debt and its extension called credit. However, everyone guiltily knows is it better to be paid interest than to pay it. Everyone knows life expectancy has lengthened, but not everyone realizes the cost implications. And even Aristotle despaired of the way we ignore the way compound interest sharply increases at the far end; it's J-shaped, too. Let's start by re-emphasizing what everyone supposedly knows already.

|

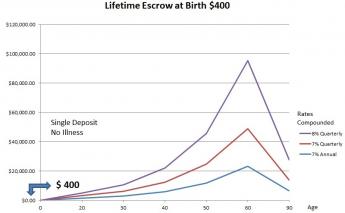

The Cushion. The first hypothetical graph illustrates a tax-free escrow account, into which only $400 is deposited at birth, and terminates at death 90 years later, accumulating wealth until age 65 but then spending it down for retirement. The numbers are arbitrary. That is, it begins with a manageable sum but eventually produces a modest retirement, just by sitting still. This is the "accordion" we employ to substitute for our obvious inability to project costs and revenue for a century ahead. It assumes an average income of 6.5%, which is justified by the history of the past fifty years, which show a high of 8.6% and a low of 4.5% in successive thirty-year slices. Actually, as my son shows in the appendix, it is the more conservative modal value rather than the average, to satisfy actuaries who will be asked about it. We have only partial data for fifty years before then, and even sketchier data for a century before that. But the data seem to justify the same conclusion for a long time, in spite of countless wars and recessions. This isn't the plan, it is the cushion which would support the plan if it failed, intended to show our proposals remain within the limit of what is conceivable. No one, of course, can claim to predict the future with precision.

Measurement Inaccuracies. According to accountants, revenue always equals costs, accountants then stretch things a bit to make it happen. But in projecting the future we sometimes substitute one for the other because data is more available. When you dig into how these numbers are produced, you see their premises, hence their inaccuracies, are sometimes quite different. That's a fact which misleads the reader when the two curves are superimposed, allegedly displaying profits and deficits as the difference between cost and revenue. Sometimes it also misleads executives, who have to scramble to keep the company (or the nation) afloat in a mismatch. Without going into boring details, this explains much of the empiricism of the planning process. Sometimes, just sometimes, the Board of Directors acting on logic, knows better than the CEO, acting on data. In healthcare, the central actor is the dismaying alacrity with which costs react to reimbursement.

A Harpoon for Leviathan. And having long experience with the conflict between the welfare of the individual patient and the welfare of the organization, doctors instinctively resist the efficiencies which allegedly result from placing centralized control more and more remotely. Remote, that is, from the patient, who then suffers from the choices being made. Therefore, the "disintermediation" which is implied by individual health accounts immediately appeals to physicians and should appeal to patients, even though it is easily shown that running a tight ship is best for the organization. Therefore, while using Abraham Flexner's ideas as a model ultimately added thirty years to life expectancy, it could not stop its own momentum to adjust to the retirement consequences of improved longevity. People instinctively sense some control must be restored to the patient. Even if they were not so much cheaper, giving patients individual control of their own Health Account balances is the least disruptive place to give patients a harpoon for Leviathan. Prices have wandered too far from costs, and that's a fact.

The Plan in Outline. We assume many things will remain unchanged. Health costs will remain J-shaped, low at the beginning, high at the end. We assume life will continue in three stages: dependent children for thirty years, working and earning for thirty years, and retirement for thirty years, all more or less. We assume some transfer system must exist, so the one-third in the middle can support the two-thirds at the ends. And we assume that research efforts (now $33 billion yearly) will continue until there are essentially only two costs left: the first year of life and the last year of life. Diseases will first concentrate on Medicare, and then gradually fade away. There will be many ups and downs before it takes place, but eventually, that will be the final configuration. Since there are many programs for health, broken up and overlapping, eventually most of the existing structures will change, merge, or disappear. We started with health costs paramount but will end with retirement costs dominant, birth and death continuing as appreciable costs. Finally, most of the next century will be spent in the transition from what we have now, to birth, education, retirement, and death, with education, perhaps going its own way.

The Plan. Technically, the plan revolves around birth and death re-insurance, possibly renamed First and Last-year of Life Re-insurance. Assuming this is the final configuration toward which we are working, our new plan should deliberately aim for it, meanwhile coping with the individual changes science forces on us. One lucky thing is that everybody alive has already been born, so it is not so urgent to cope with that transition quite so urgently. That's good because the transition to the last year-of-life will be complicated enough. Re-imbursing Medicare for terminal care costs should reduce the Medicare withholding tax for working people, allowing that amount to be directly transferred to escrowed partitions of individual HRSAs, instead of indirectly through intermediaries. Growth of this money in the escrow would be the new money for the system, so the individual must negotiate an income rate with his HSA vendor, at least matching the Medicare inflation rate, before he would be able to accept the system of transfers. However, the amount needed is astonishingly small, since it multiplies many times in the process. The transfer, or whatever it is eventually called, of $100 from the withholding tax to the escrow fund at age 25, would generate (at 6.5%) $100,000 at the person's death at age 84. The cost of the last year of life, currently, is said to be $25,000. Paying for the rest of Medicare at current prices might require $300 more. Paying for all of Medicare plus a retirement income from 65 to 84 would depend on what you think is a moderate retirement. But paying an additional retirement of $20,000 a year (amounting to $40,000 per couple) would cost an additional $4000. That's a lot of money, but remember the present total contribution to the withholding tax is $227 billion, or roughly $6800 per worker per year. There's no need for precision in such numbers, but beneficiaries and benefits get added so quickly it is silly to be more precise. The conclusion is obvious that there is plenty of money in this approach. The potential difficulty lies in the transition.

Don't turn your head to spit. Please remember that the secret of this approach is to use two funds gathering income simultaneously from opposite directions. Since 7% of income doubles the fund in approximately ten years, using two funds in opposite directions results in doubling the doublings. The success of the venture thus lies in maintaining a reasonable income in competition with your own intermediaries throughout, either through excessive fees or confiscation by the sovereign. Whether the danger is called default, inflation, or outright confiscation, the expression for this is "imperfect agency", and it has endured as long as governments. The only nation with a Constitution to last 200 years can be the only nation to resist imperfect agency, as well. But it won't happen without vigilance. Since some of the religious divines in my own family tarnished their record, the advice they give in Texas is, "Don't turn your head to spit."

There's a deficit in this system, occasioned in 1965 when generations of new Medicare recipients (like my own mother) were given Medicare without contributing to its costs. Congress will have to decide how to cope with this, possibly by absorbing it, possibly by taxing heirs of the beneficiary (like me), who will probably protest about ex post facto. If that approach is blocked, the new investment money will have to be taxed for it, somewhat delaying its benefits. However, transition costs are nothing new to Congress, and a variety of methods have historically been applied. This proposal eventually envisions enlargement to include the second-to-last year of life, etc, while the first year of life might even start from birth to age 25. Working from both ends, the transitions should eventually be complete, and Medicare should gradually shrink. So long as the excesses in the system eventually go to support retirement income, it should be possible to grow our way out of the Entitlement squeeze. Its long term hopes probably rests on research discovering cures for expensive diseases, diminishing the costs of Medicare, but longevity will also increase, so increased retirement costs must be considered as well. This proposal must be considered a long-term transition plan of uncertain length. Present beneficiaries of Medicare can rest assured that dual systems are practically inevitable for quite some time.

It is the present intent to regard the Affordable Care Act as revenue-neutral since it is not possible to predict what it will actually be. So the problem of the first-year-of-life may not need to be addressed immediately, but ultimately the plan is to over-fund the last-year costs by about $400 (sound familiar?) and distribute $100 to funding newborns by inheritance at the death of what would be their grandparent, reserving the remaining $300 for the last year of their parents. To make all of this come out right, the present 2.1 births per mother would translate into $200 per child generation and $400 per grandchild generation. But there are four grandparents, so it remains $100 apiece per grandchild.

Let's now turn to health insurance for newborns, which pose new difficulties.

Originally published: Wednesday, May 18, 2016; most-recently modified: Monday, June 03, 2019