Related Topics

Right Angle Club: 2015

The tenth year of this annal, the ninety-third for the club. Because its author spent much of the past year on health economics, a summary of this topic takes up a third of this volume. The 1980 book now sells on Amazon for three times its original price, so be warned.

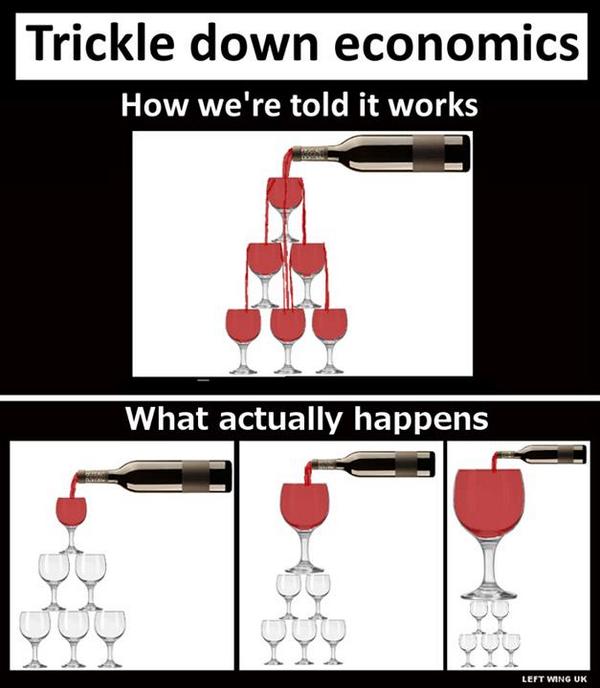

Why is Capitalism Usually a Top-Down System?

|

| "Trickle Down" |

During the Great Depression of the 1930s, someone coined the phrase "Trickle Down" as a disparaging reference to how capitalism treats poor people. The implication lay in the choice of the word "trickle" instead of "pour", invisibly suggesting that rich people take care of themselves first, and poor people only get a trickle. By implication, a socialized system would start with designing programs for the poor, and if there is anything left, give a little of it to the undeserving rich folks.

Class warfare language is always intentionally divisive, but it works best during times of hardship when even the richest people get a little worried about their future. Even so, it is hard to reconcile with the spread of televisions and used cars among the poor, and is most useful when managers are confronting labor representatives for a larger share of profits, as contrasted with a larger share for owners. It's also hard to reconcile with free public schools for everyone, which frequently remain substandard because the teachers can't control the pupils, who sometimes prefer recreational drugs and a lifelong vacation from work. The problems of schools do pose a threat of creating a permanent underclass.

|

| Samuel Gompers |

Since a fair division of profit has never been precisely defined, Samuel Gompers defined the true position of labor as simply demanding "more". It's a little hard to deny that rich people are usually owners, not employees, with basketball stars and symphony musicians perhaps excepted. And it's also hard to deny that someone has to do the humdrum work if risk-taking is going to remain attractive to those who have assets to risk. At times when interest rates approach zero, it becomes starkly apparent the penalty for unwisely investing assets, is losing your assets. That is, avoiding being poor is a major reason for trying to be rich. As lengthening longevity offers a fair opportunity for everyone to end his life with a thirty-year vacation, it clarifies everyone's thinking to imagine savings running out, while there still remains ample time to "enjoy" a vacation from work.

|

| Robert Morris |

An esoteric way of looking at things is to realize that wealth creates credit. Credit is not debt, it is the unexploited ability to borrow, as first discovered by Robert Morris and Alexander Hamilton. It is often stated that banks create money by doubling it; it's probably more accurate that rich people double the value of their wealth by creating, but not using all of, their credit. It's spendthrifts and phonies who use it all. When someone climbs out of his Rolls Royce, you can't tell if he has used up his credit or not. But bankers know; you stop paying your bills on time if you have no credit left. Just about the only way an ordinary person can efficiently use his credit, is to buy real estate. So almost all stock market crashes grow out of an overextended housing boom. Mortgages are the main way to transform wealth into debt, and the rest just follows, even though you gradually pay down your debt and rebuild your credit. The crash isn't over until the debt is mostly re-converted into credit, which often takes a decade.

|

| Alexander Hamilton |

So while the punishment grows clearer with each additional year of idle longevity, the cause is not clarified that way. For whatever reason, some members of society are motivated to start businesses, even though those businesses are sometimes directed toward improving lifestyles which need little enhancement. A few entrepreneurs are able to fast-talk a loan from a banker, but generally speaking, you must own some assets in order to risk those assets. Except for the extremely wealthy, such people choose between investing those assets to enhance them and spending them without expanding their credit. Some do, and some don't; the difference may be hereditary.

A wise parent sees this coming, and steers his brighter children into the professions, his duller ones into the military, where recklessness is sometimes rewarded. Life in the sciences or arts is harmless, and may even have some utility. Some families prefer their children to go into the ministry or direct charities and do not greatly object to sports, excessive drinking, or repeated marriages. But these families are depriving their children of better examples; the average family prefers hard work and diligence, savings and frugality. Not everyone can play polo well, or even marry a glamorous heiress, but almost everyone can work hard and perform a simple task for the less enterprising. Everyone can be frugal if bad companions are avoided. It's not merely having opportunities, it's probably choosing which examples to follow that matters.

Originally published: Thursday, December 03, 2015; most-recently modified: Wednesday, June 05, 2019