Related Topics

No topics are associated with this blog

Coordinating New HSA with The Affordable Care Act.

Starting with N-HSA We have just described the general outline of New Health Savings Accounts (N-HSA). Essentially, it consists of individual HSA funds for children, connected to Medicare by permitting the funds to sit in escrow from age 21 to age 66. However, the amount which can be accumulated during childhood is small, and the task it is asked to perform is large. Because children are so lacking in income, they can't be expected to accumulate much, even though their grandparents may have helped out. Consequently, that small amount multiplied by compounded income for 45 years, will probably only pay for one designated segment of the Medicare program, and it is unlikely it would be able to pay off much of Medicare's accumulated debt.

So, although it can be shown to be workable, it would look like a long run for a short slide, to an economically illiterate family. Meanwhile, its political enemies would likely describe it as meddling with Medicare, and its chances of achieving the necessary enablements would shrink. However, the grand discovery is, the Health Savings Account idea resembles how President John Adams once described his native Boston -- Every goose is a swan. Every problem we encounter, that is, seems to suggest an unexpected new improvement. Let's explain the three accompanying graphs.

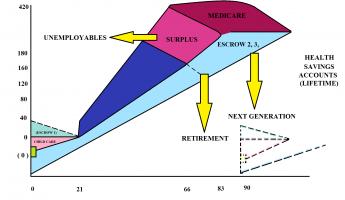

Three Graphs. The top graph shows the situation, without either a bridge around or participation in, the Affordable Care Act. The HSA escrow comes to a halt for 45 years and then resumes with Medicare. There are two savings accounts, but each starts at zero and lasts two decades. One is an escrow account, unspendable until age 66.

The middle graph imagines the situation with a dormant escrow gathering interest during the 45 years. Notice the thickened blue escrow.

The bottom graph is a cutout enlargement of the transfer point for grandpa's gift, showing how easy it would be to adjust the escrow transfer from zero to $29,000. The difference between the extremes added to the escrow is the difference between solvency and riches. To imagine a small deposit spiraling out of control is probably a little fanciful, but for those who worry, here is a ready solution.

Adding Obamacare. If we achieve political consensus, and thereby add the subscribers from age 21 to 66 (the only age group which reliably produces real new wealth), the arithmetic suddenly transforms. The complete system from cradle to grave generates enormous surpluses. After studying this paradox for some time, I came to realize that what distinguished it from Lifetime Health Savings Accounts (L-HSA) was the two, eventually three breaks between programs, where the escrow fund could drop to zero, without some agreement to transfer it between insurance programs. If it drops to zero, the effect of compound interest rising at its far end is chopped off, and overall returns are much reduced. The whole idea unfortunately then becomes politically precarious and runs the risk of some small glitch somewhere unraveling it. To use our own descriptive terms, three Classical (C-HSA) funds are nice, but one Lifetime (L-HSA) is so far superior it raises grandiose questions of starting an inflationary spiral. But in a sense, the radical Right is correct. The changes to the Affordable Care Act must be drastic enough to generate public support for merging the radical plan of the left with a radical plan of the right, essentially making both of them unrecognizable. I'm no politician, but I can easily imagine the difficulties of that negotiation.

|

The Goose is a Swan. But I came to see that what makes it impractical is the same as what makes it so glamorous. The possibility of linking the healthcare fund to the stock market would likely be brushed aside by the explosions of a money machine -- the system as originally envisioned for L-HSA generates almost any amount of money you please. That's a pretty intolerable effect of inflation heedlessly disregarding any monetary standard, even a return of a gold standard.

But if the HSA is more or less denominated in index funds, it essentially has a monetary standard built in and could maintain it if someone held a meat ax in reserve. Some impregnable threat is needed to control the monster, and it is provided at the three linkage points, where the three existing insurance programs connect.

|

Three Meat Axes. The connection after the children's escrow fund is the most leveraged and therefore the most sensitive since we have already demonstrated how the difference between zero transfer between two funds, and the transfer of $27,000, is the difference between marginally paying Medicare bills, and having money to burn. If some totally reliable monetary angel could be discovered and put in charge of it, the discretion about inflationary consequences could be placed in one pair of hands.

But the history of inflation has been that even Kings, Popes and Emperors have succumbed to the temptations of such power. Remember, this fund is truly generating $350,000 of new wealth per person (in a nation of 300 million inhabitants) if it operates precisely as hoped, so it starts with some latitude. There are several Presidents of the nations of the world, who might fairly be suspected of raiding their own currency right at this moment, however. Wisdom suggests more caution is necessary. For example, Congress could permit a discretionary band within which the Executive branch could operate, perhaps in consultation with the Federal Reserve. That might permit Congress to create some very difficult hurdle for the process to jump, for widening the limits of the band, such as a Constitutional Amendment.

There's an End in Sight. And also remember, my colleagues in the research department are busy looking for a cure for cancer and Alzheimer's Disease, and I feel confident they will eventually have success. Just cure diabetes, schizophrenia, or birth defects, and our problem with Health Savings Accounts would transform into how to turn them off. In the meantime, we must modulate the ups and downs of medical costs which are steadily becoming less urgent. Take warning from the recent example of the price of tetracycline, which a year or two ago was 35 cents retail for fifty capsules, and suddenly jumped to $3.50 for a single capsule. And then with a new owner, jumped to thousands of dollars. If things like that continue to happen, we might be ready for another pet scheme of mine, the limitation of health insurance coverage to covering the first year of life, and the last year of life, by eliminating most of the disease in-between. Because of the helplessness of both these population groups, and the universality of the need for their coverage, in their case alone drastic interference with market mechanisms might appear justified, to those who are injured by them. The rest of us ought to have a say in something like that. But that's another book, for another time.

We're some way from seriously having that type of problem, so let's get back to details. For this purpose, paying patients arrange themselves into only three groups, children, working folks, and Medicare recipients. Thus there exist three breakpoints between these three programs for different ages, assuming Congress authorizes transfers between them, especially from grandparent generation to grandchildren, incidentally relieving the middle generation of a lot of cost-shifting. There is now so much (necessary) cost shifting, it is nearly impossible to sort out the cost numbers. So I won't try to do it, except in a sort of general way. Rationing is a sort of a lip-service concession to the wide-spread liberal endorsement of a single payer system, endorsing but without facing the resultant deficits in every direction. Instead, we encounter the worrisome potential for generating too much money, even though that is hard to believe without endorsing galloping inflation. There is little difference between external transfers -- between insurance plans, and internal transfers -- within one mega-institution -- except, in this case, one approach creates impossible deficits, and the other approach raises a real concern about inflation. A compromise might be devised, but it requires some sort of conciliatory response from both sides, for even a beginning.

Meanwhile, I don't scoff at the legal issues of who is responsible for those bills, if we destroy the family unit with exciting new social liberties. And I haven't forgotten the problem of corporate finance officers, who have run a confidence game for eighty years, making money for the stockholders by giving away health insurance to employees, as long as they can conceal what they are really doing. We've suggested in this book, we should offer the business a reduction of their corporate income tax to levels comparable to individual tax levels, in return for getting them out of the health insurance business. In a sense, it returns the favor of making a profit by giving away a service benefit, by -- generating revenue for the public sector in return for reduced taxes in the private sector. I'm entirely serious about offering major corporations a one percent cut in corporate taxes for each two percent reduction in fringe benefits tax exemption, down to the point where the top corporate income tax rate is equal to the average individual tax rate. That benchmark is selected because of the temptation otherwise created, to elect Subchapter C to S inter-conversions, exploiting such tax differences. The international corporate flight is another serious consideration. Meanwhile, it is always possible to equalize employee tax exemption by allowing HSAs to purchase catastrophic insurance through the HSA itself, if the law would permit it.

Inflation Protection. Q. Now, wait a minute. If we permit a money machine to be built, what is to prevent it from resembling the galloping inflation which ruined the Weimar Republic? And if we devise a way to keep the United States from going down that road, how do we prevent a hundred small foreign states (Zimbabwe, for instance) from doing it deliberately in order to use their sovereign status to acquire the index funds held by Health Savings Accounts?

A. You've almost answered your own question about Zimbabwe. Even without freely floating currencies, the markets are quick to detect changes in the value of the foreign currency. Zimbabwe can force its own people to accept pennies disguised as trillion-dollar bills, but everybody else avoids them, whereas bitcoins don't even have sovereign power. And as for our own domestic currency, I propose we enact a band of fluctuation in consultation with the Federal Reserve, within which the dollar can float, and beyond which the band may not be expanded without a Constitutional Amendment, again in consultation with the Federal Reserve. In two hundred years, the amendment process has only let one matter (Prohibition of alcohol) slip past, which had to be revoked after the experience with it. Almost every other indiscretion has proved to crumble in spite of the temptation to raid the cookie jar.

Watchdogs. Three breakpoints, one between each age group, with wildly different medical needs and financial viewpoints, need watchdogs. Since going to zero between any two of the three insurance programs could bring inflation to a halt, and since venality knows no political boundaries, I suggest each breakpoint be governed by a different political entity, composed of a board nominated by a different branch of government, and each ratified by a different process. It may or may not be necessary for them to share the same information agency, since think tanks are very popular right now, but may not continue to be. We will need another conference in a resort hotel to work out a paper but keep in mind that foreign powers will be anxious to infiltrate and subvert it. So maybe we need two conferences, one to review the other. After all, we are talking about 18% of the gross domestic product, and Benjamin Franklin isn't available anymore.

Originally published: Friday, July 10, 2015; most-recently modified: Wednesday, May 15, 2019