Related Topics

Right Angle Club: 2015

The tenth year of this annal, the ninety-third for the club. Because its author spent much of the past year on health economics, a summary of this topic takes up a third of this volume. The 1980 book now sells on Amazon for three times its original price, so be warned.

Passive Investing

|

|

| Roger Ibbotson |

Roger Ibbotson compiled the results of investing in the past hundred years and divided it into different aggregate classes of investments -- large capitalization common stock, small capitalization stock, bonds, and whatnot. It happens that Burton Malkiel showed that such aggregates outperformed most mutual funds with the same goals, and John Bogle of Vanguard showed that index funds of such asset classes also outperformed stock-picker managed mutual funds, mostly because of lower costs.

|

| Burton Malkiel |

The eliminated costs included the cost of stock-pickers, who are often highly compensated, sales costs, and transaction taxes from frequent turn-over. He invented the term "passive investing" for the purchase of index funds rather than individual stocks, and it's easily understood why index funds would have lower costs than managed portfolios. Mr. Bogle's index funds in the Vanguard Group have an annual transaction cost of less than a tenth of a percent, while it is not uncommon for managed funds of common stocks to charge $250 or more, per trade. In a few years, index funds have grown to be half of the market, giving direct stock investing a very hard time of it. Buy them, hold them through thick and thin, and scarcely ever sell them. The consequence is that passive investing of this sort returns two or more percent more to the investor.

|

| Vanguard Group |

Multiplied by the compound income principles mentioned earlier, passive investing is pretty well sweeping the Health Savings Account field. In fact, most managers of HSA are having a difficult time deciding how to charge for other necessary services, like debit card management, sales, transactions, and advice. The most conservative of all small-investor vehicles, like money-market funds, bank certificates of deposit, and other savings vehicles, are currently suffering from such low-interest rates that even they are being abandoned. In the peculiar financial environment of the present time, investors who shunned stock purchases as "gambling", find they have almost no other choice for their Health Savings Accounts. Investment management firms who depended on non-stock investments, are simply driven out of business if they don't switch to passive investments.

|

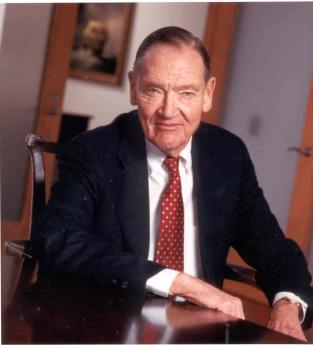

| John Bogle |

That's really all there is to say about passive investments for Health Savings Accounts, except to say it should be a good thing. Common stocks have out-performed just about everything else for a century. The small investor tends to be afraid of them because of the "black swan" crashes of 2008 and 1929, which students of the subject tell us to occur about once every thirty years. We, therefore, should take a moment to address this problem, because various reactions to it, can have a very large effect on something the investor should be watching carefully, the percentage return on his investments. Multiplied by the compound interest effect of longevity, this is really the key to whether the HSA will be effective in lowering healthcare costs.

Originally published: Sunday, June 07, 2015; most-recently modified: Friday, May 31, 2019