Related Topics

Quakers: The Society of Friends

According to an old Quaker joke, the Holy Trinity consists of the fatherhood of God, the brotherhood of man, and the neighborhood of Philadelphia.

Right Angle Club: 2014

New topic 2013-11-19 20:22:11 description

Too Much Money

|

| The Gold Rush |

Globalization may well have created a thousand billionaires, but its benefits to poor people were greater. As a guess, five hundred million desperately poor people were lifted out of poverty, and eventually, it may be several billion. For certainty, we will soon need a new definition of poverty, which only a few years ago was to subsist on less than a dollar a day. Rich or poor, these lucky people were not the objects of charity, but the visible beneficiaries of enormous wealth creation, surely the greatest gold rush in human history.

If they buy guns and bombs (or narcotics) with their new money, we may not be so happy about its unintended consequences. So far, however, the major unintended consequences have been benign upheavals, like the rapid spread of the computer and internet revolutions, the extension of life expectancy and literacy. These reasonably benign side-revolutions have bounced back as accelerators of the boom. The unit cost of transactions has plummeted; nerdy mathematicians have advanced into the murky mist of derivatives. No one doubted self-seeking bosses would abuse the extraordinary insights of their intellectual superiors, and they did, indeed. It's probably true that wise observers predicted this would all end in tears. And it did.

|

| Credit Default Swaps |

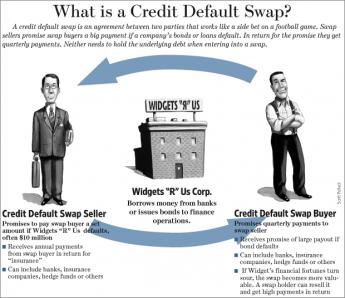

We are now in the midst of the usual witch-hunt for perpetrators because we have a national election every four years. Both political parties are planning to spend a billion dollars accusing each other, so the accusations will surely get louder before they calm down. But in the spirit of directing the anger toward more productive targets, it should be remembered that harm to the public usually originates as incompetence, rather than greed. About five years before the crash, for example, I found myself adrift in a convention of bank officers. Within fifteen minutes, I satisfied myself that not one vice-president in the room could offer a coherent definition of a derivative. The general public still cannot define it, but everybody thinks he can recognize greed: it's someone with more money than you have. A few weeks before the initial crash in August 2007, I was made aware that things called Credit Default Swaps were in circulation in the amount of twenty-five trillion dollars. It was impossible for me to find anyone or any search engine which could tell me what these confounded CDS things were, even though their quantity exceeded what I understood to be the national debt of the United States. And their quantity was doubling every few months. A few months later, indeed, it was made clear that the national debt was far larger than anyone thought. There's a great temptation in a situation like this to demand that Congress pass a law to slow things down. Yes, and while they are at it, they might as well sweep back the ocean with a broom.

|

| Federal Reserve |

To a certain extent, the recent cluelessness of banks has to do with expanding their size, computerizing the deposit and payments systems, and reducing the average branch bank to a single manager with either computers or new hires to help him. The information you need is available, but often in the home office a thousand miles away. Changes of this sort are hard to keep up with, and the bank officers dislike it, too. But the plaintive defense was recently given to a Committee of Congress, seen on television. "As long as the music keeps playing, we have to keep dancing."

Over in the investment banks, there are hundreds of very smart, very aggressive young fellows sitting at desks crowded together with three electronic monitors apiece, talking excitedly on the phones with their new best friends in foreign countries. Their job is not to know everything, but to know how to do something, and perform it very rapidly. Much of their knowledgable talk is just bluffing; no one is sure what the other fellow knows. They all know the situation can't last; perhaps they can get promoted before some changed premise catches up with them. This isn't exactly greed, it's called high pressure. At any unexpected moment, that guy over in the corner office can come out and say, "You are all, all of you, fired as of this moment." It probably isn't his fault, either.

The fundamental situation is that depository institutions are being squeezed by technological change and the blameless fact that investment banks can substitute their services at a lower cost because the money is accumulated by selling bonds in large denominations. The depository banks must try to accumulate deposits one by one in a recession, with interest rates held low for macroeconomic reasons dictated by the Federal Reserve. To level the playing field, depository banks have access to deposit insurance, which tempts them into high-risk lending. Nobody can get hurt when it's all insured, Right? Every once in a while someone sends cold chills down the depository bank spine by calling for the abolition of deposit insurance, on the grounds that it promotes moral hazard. On the other hand, the investment banks are lobbying heavily to have deposit insurance extended to them, and they may well get it for their money market funds. This is all a pretty artificial controversy. The problem isn't evil, or deposit insurance, or being too big to fail. It's the nature of the struggle. Two different ways have been chosen to assemble capital. When one of them wins, the other knows it will die.

Let's not confuse this any further. The point of the discussion is to convey the immense pressure being placed on every mini pixel of the financial system, by a gold rush taking advantage of the changes wrought by the globalization of the world economy. Somewhere, a bubble will appear. It happened to be in real estate, as it often is in money panics. And if a bubble grows, somebody will pop it. Is it all his fault, too?

Originally published: Monday, June 11, 2012; most-recently modified: Thursday, June 06, 2019