Related Topics

No topics are associated with this blog

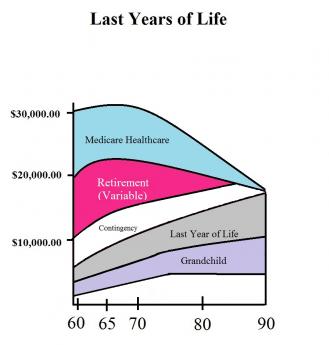

First Year-of Life and Last Year, Combined

The most casual reader must have noticed compound interest curves make these lines crawl along the bottom for young people, but widen greatly for older ones. The consequence is the money is to be found in the old ones, who incidentally have less time left to spend it. Therefore, strategies must be devised to transfer money or credit from grandparents to their newborn grandchild. It is violently in conflict with our economic structure to suggest the government become a competitor in the private sector, so why not go along with our culture, and make the transfers by inheritance? It's an ancient problem, and the Society has finally decided the limit of perpetual transfer is one lifetime, plus 21 years. That's plenty of leeways to solve this healthcare issue, without either creating new rules for an aristocracy or allowing the umpire to play in the game.

|

Each woman now has 2.1 children in America, so it works out that each grandparent has one. Each grandparent also has four grandchildren, because of marriages, and with his wife, they have eight grandchildren to favor. Beyond that, the courts can figure out what to do with outsiders. The grandparent has just been shown to have money to burn if we recirculate it among generations, always stopping at one lifetime plus 21 years. It's easy to see that some grandparents and grandchildren cannot stand the sight of each other, but that is not for this book to worry about. The essence of this scheme is to transfer less than a thousand dollars between generations, somehow staying within existing laws and conventions. One transfer would be about $400, as a contingency fund to generate ample excess to smooth out faulty planning, especially the first time around.

Eventually, the plan is to transfer $25,000, to pay for the first 25 years of the grandchild's healthcare. That comes from the surplus generated at the death of the grandparent, which in turn is generated by compound interest gathered from invested withholding taxes of the grandparent, which the grandparent supplied by being employed. The extra money in circulation is gathered by his Health Savings Account, invested in the whole national economy by way of total market index funds. In a sense, the whole nation becomes an investor in the whole economy. Just as the idea of affordable housing had unexpected consequences, this also would need to be carefully studied, even pilot studied, before final implementation. The function of this book is to point out this source of revenue exists and has not been fully exploited.

Originally published: Wednesday, May 25, 2016; most-recently modified: Friday, May 17, 2019