Related Topics

No topics are associated with this blog

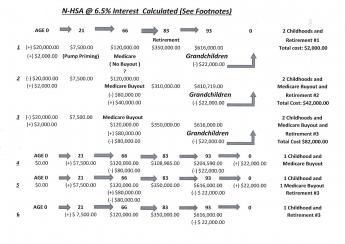

Footnotes to N-HSA Table

Footnotes run from 1-6, vertically, and each line represents a type of New Health Savings Account. The headers are repeated several times for ease of reading and represent the age of the subscriber at the time of action. He is born at 0, reaches adulthood at 21, achieves Medicare at 66, and dies at either age 83 (as at present) or 93 (estimated longevity in a few decades). A(+) sign indicates money is added to the account, a (-) means a transfer out of it. Sacrificing precision for clarity, these numbers are severely rounded off.

Spending on healthcare is not shown, and spending for retirement requires a little explanation. The value given is what would be expected to be the balance if no money is spent on retirement at the age of death. Much of this amount, especially in later years, is what would be expected to be in the account if its income averaged a steady 6.5%. Therefore, any spending will not only reduce the balance by that amount but will reduce the future balances by 6.5% times the number of years remaining in his life. This could be considerable at age 66, but less so as the final year approaches.

To come closer to actual amounts, estimate your own life expectancy and divide it into the remaining balance. This will still overestimate future balances by the lost income. Since there are no medical expenses if the individual retains Medicare coverage, the retirement income is merely the surplus overflow, to show that funding a grandchild HSA is easily possible. The retirement income can be raised by making extra deposits before age 66, resulting in a gross increase of about tenfold, but requiring more calculation to reduce it by IRA taxes and the aforementioned loss of income. A conservative guess is to triple the deposit.

|

Line 1 Shows the experience of a child who Receives $22,000, and immediately invests $2000 of it, but uses Obamacare to fund his health from 21 to 66, and Medicare from then on. Any costs from that source are not shown, and it is presumed his $20,000 is consumed from birth to age 21. He has ample funds to transfer $22,000 to his own grandchild, plus the indicated gross retirement amount.In summary, the New Health Savings Proposal is suggested to wrap around the Affordable Care Act, assuming it to be in force, but requiring no cross-involvement. The calculation of its income stream through passive investing is clearly able to support children's health care from birth to age 21, plus either a Medicare buyout or a considerable advance in retirement funding.Line 2 Shows the same child, who decides to buy out his Medicare coverage, and adds a $40,000 tax-deductible deposit at age 66 on the assumption costs will go up. He retains a small retirement fund.

Line 3 The same child is worried about retirement, and adds $80,000 tax deductible, and increases his maximum retirement fund by $200,000. In this case, the profit is taxable, unless it is used for approved medical expenses.

Lines 4-6 Assume a buy-in of the children's program at age 21.

Lines 1-3 Assume a subsidy of $2000 into escrow at birth, and the initial $20,000 children cost is only an arbitrary assumption.

Lines 2,3,4,5 No provision is made for payroll deduction, premiums, or debt. All of these could affect buyout price.

Following its first generation, it would be self-funding, and the startup cost should not exceed $2000 per person at birth or $7500 at age 21. Beyond those ages, its funding is scanty for more than one feature, either a Medicare buyout or a meaningful retirement supplement. Its viability would be considerably enhanced by removing the age limits for Health Savings Accounts, and tax deductibility for catastrophic health coverage.

Originally published: Thursday, July 30, 2015; most-recently modified: Friday, May 17, 2019